APEX Insights > Your Business > Advisers ‘need to be on top of housing market risks’

23 March 2018

Advisers ‘need to be on top of housing market risks’

Almost eight years ago in the wake of the financial crisis, US investor Jeremy Grantham created an uproar when he warned the Australian housing market was a “time bomb”, saying prices would have to come down by 42 per cent to return to their long-term trend.

Grantham, co-founder of Boston-based asset management firm GMO, is a highly regarded investor, having accurately predicted some of the mayhem of the financial crisis a year before it unfolded.

His dire prediction about Australia’s housing market never came to fruition and housing values in both Melbourne and Sydney have risen more than 100 per cent since 2009. But now, as much as then, the hawkish views of overseas experts about Australian home values should at least give financial advisors pause for thought.

Housing boom hangover

And that demands a thoughtful look at the International Monetary Fund’s fears about the Australian housing market, which were front and centre in its annual review of the Australian economy, released in February.

Over the past six years, price increases in Sydney drove residential property prices to more than five-times gross household disposable income, the fund warned in its report. Household debt had also ballooned from 168 per cent to 190 per cent of income on average.

“A housing boom has supported the Australian economy’s adjustment to the end of the [commodity price and mining and investment booms of the 2000s], but has led to housing-market imbalances and household vulnerabilities,” the IMF warned.

And while the IMF did not predict a sharp price correction, it said the market was 5 per cent to 15 per cent overvalued.

The current cooling of the market could be “less benign” than expected if an unexpected negative shock were to occur to the Australian economy, and could lead to “larger non-completion of large apartment projects already approved and tentatively pre-sold on deposit, lower dwelling investment, and a larger house price correction …”.

By contrast, the Reserve Bank of Australia appears comfortable with levels of housing debt. In a speech on February 20, assistant governor Michele Bullock pointed to Australia’s relatively low level of non-performing housing loans and falling levels of repossessions. Owner-occupiers were an average two-and-a-half years ahead on their repayment schedule, she added.

“The overall level of stress among mortgaged households remains relatively low,” Bullock said.

One explanation of the difference in views between the IMF and RBA is how they account for the steep rise in houses prices over recent years. For the IMF it’s a matter of low interest rates fueling the market; while the RBA points to slow land supply to build new residences as a key culprit in pushing demand and therefore prices.

A key point of difference between the IMF, which points to low rates, and the RBA, which points to slow supply of land to build, is in what they see as the source of steep price growth in Australian homes over recent years.

The burden of household debt

So what should financial advisers make of this? Advisers “definitely need to be on top of some of the risks around the market” when advising their clients on property purchases, ANZ senior economist Daniel Gradwell warns.

While Gradwell broadly predicts property prices will rise moderately in most Australian capital cities over the next year, he has concerns about the ability of new market entrants to service their loans if interest rates rise faster than expected.

“Affordability still looks OK because of low-interest-rate-levels,” Gradwell says. “If that starts to change, especially for people who just bought into the market over the past year or two, they will come under pressure fairly quickly.”

There are reported signs of mortgage stress being a problem even in some of Australia’s wealthiest suburbs, with research by Digital Financial Analytics showing thousands of households in the expensive capital city suburbs of Mosman, Brighton and Nedlands under financial strain.

While newer buyers are at risk, the overall market isn’t particularly sensitive to rate movements and most borrowers have a good savings buffer, ANZ’s Gradwell says. And with current inflation levels it is hard to see a real acceleration in rates in the short term.

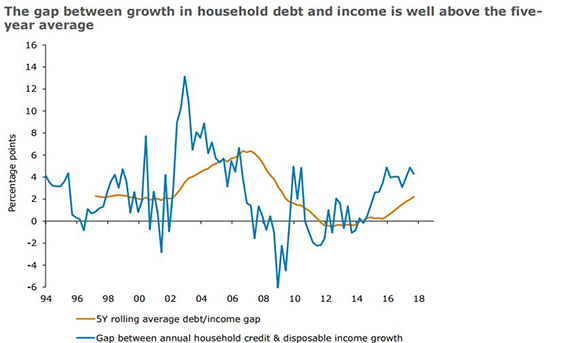

But household debt continues to grow faster than household incomes. ANZ head of Australian economics David Plank wrote in a February 27 research article that this growing gap between incomes and debt is unlikely to stabilise with a cash rate remaining at 1.5 per cent unless the Australian Prudential Regulation Authority introduces a new set of punitive lending restrictions.

“We think the RBA’s current comfort with developments in household debt will be challenged later this year,” he wrote.

Source: CoreLogic/ANZ Research

Impact of immigration, negative gearing

Gradwell also warns of the Australian housing market’s vulnerability to shocks, such as a change in the political climate that causes a sharp slowdown in Australia’s immigration intake.

“If we saw a political change that maybe turns off the tap of immigration, you take that demand out of the market and that would also be a risk for prices,” Gradwell says.

He is less concerned about Labor’s proposal to restrict negative gearing to new homes, saying it could put some downward pressure on pricing in the short term by pushing some investors out of the market, but any long-term effect would be modest.

“That withdrawal of demand might see prices drop off a bit, but given we know there are so many people priced out of the market, I think they will be ready to step in if prices slow down a little bit.”

And he says a surge of new apartments in Brisbane has only had a “limited” effect on pricing there, with apartment prices down 5 per cent from their peak. This weakness could continue for another 12 months as more projects are completed, but he doesn’t expect significant price falls.

Property prices will rise

For now, the housing market appears to be taking a breather. National dwelling values fell 0.1 per cent in February according to CoreLogic, bringing values 0.8 per cent lower than their peak in September last year. Sydney has seen the greatest fall with housing values down 2.4 per cent over the quarter.

Gradwell predicts prices will rise in Sydney and Melbourne over the next year. Brisbane should also see some more heat in the housing market in the next two years, he says.

He doesn’t expect the heated price growth of recent years to return anytime soon, suggesting new buyers will have a long period of waiting and repaying before they develop a comfortable equity buffer to protect against price drops.

“Auction results are still healthy and point to further price growth in Sydney and Melbourne but definitely not same levels of competition we saw in 2016 and 2017,” Gradwell says.

Advisers have a range of investment types they can recommend to their clients. Before recommending property they need to be clear about the risks in the market and ensure their clients know the current low-interest rate environment might not last much longer, he says.

This material is intended for the use of financial advisers only and is distributed by OnePath Life Limited (OnePath Life) (ABN 33 009 657 176, AFSL 238341).

The information, opinions and conclusions in articles ("information") are current as at the date articles are written as specified within but are subject to change. The articles are provided and issued by OnePath Life unless another author is specified in the article, in which case it is provided and issued by that author. The views expressed are those of the authors only and do not necessarily reflect the opinions or views of OnePath Life, its employees or directors. Whilst care has been taken in preparing this material, OnePath Life and its related entities do not warrant or represent that the information is accurate or complete. To the extent permitted by law, OnePath Life and its related entities do not accept any responsibility or liability from the use of the information.

The information is of a general nature and has been prepared without taking into account a potential or existing investor’s objectives, financial situation or needs. Investors should consider whether the information is appropriate for them having regard to their objectives, financial situation or needs. For any product referred to above, OnePath Life recommends that investors read any relevant offer document or product disclosure statement and consider if the product is appropriate to them. For products issued by OnePath Life, these documents are available at access.onepathsuperinvest.com.au.

Past performance is not indicative of future performance and any case study shown is for illustrative purposes only. Neither are a prediction of the actual outcomes which will be achieved. Where tax or technical information is included, the information is our interpretation of the law and does not represent tax advice. An investor is advised to obtain professional advice relevant to their individual circumstances.