Wednesday, 1 July 2020

As you may be aware the Government has changed the age requirements for who can make voluntary super contributions. The main changes are:

A Product Disclosure Statement (PDS) Update detailing these changes is available here.

In line with these changes we are currently updating the OneAnswer Frontier Personal Super and Pension new business online forms and expect these to be updated in early August 2020.

In the meantime, please refer to the following workarounds when completing new business forms for OneAnswer super and pension members who are aged 65 and 66.

Please note: PDF forms will be available to download at onepath.com.au and hardcopy forms can be ordered from 1 July 2020.

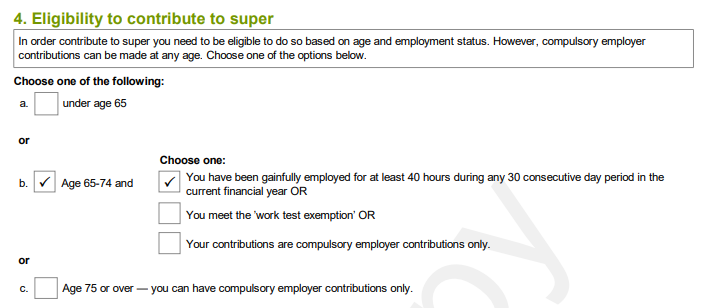

From 1 July 2020 until the form is updated please tick ‘Yes’ at the ‘gainfully employed’ question for members who are age 65 or 66 as shown below in the screenshots.![]()

The PDF output will have the correct age group ticked but the wording won’t be in line with the new rules at 1 July 2020. This wording will also be updated with the online form.

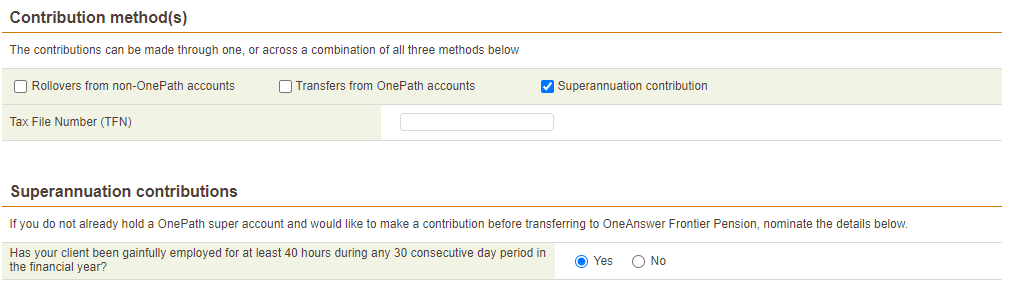

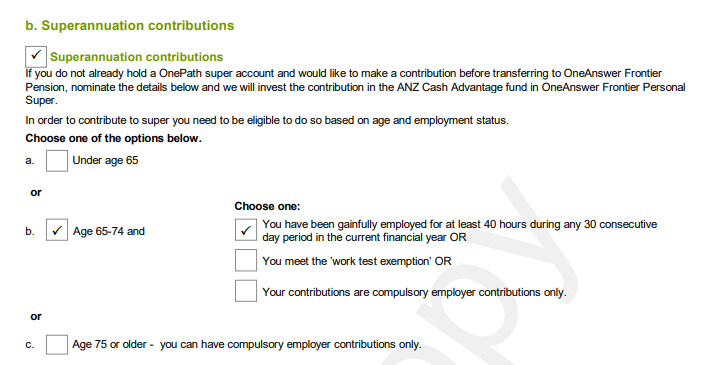

If your client is making a ‘superannuation contribution’ as part of the pension set up, please tick ‘Yes’ at the ‘gainfully employed’ question for members who are age 65 or 66 as shown below in the screenshots.

Again, the PDF output will have the correct age group ticked but the wording won’t be in line with the new rules at 1 July 2020. This wording will also be updated with the online form.

For more information about the Government changes, please refer to the PDS Updates available at onepath.com.au

If you have any questions or require assistance with the online forms, please contact Adviser Services on 1800 804 768.