APEX Insights > Insurance > How risk products are priced

March 2017

How risk products are priced

Ever wondered how the cost of an insurance policy is calculated? Nigel Bowen explains.

With the prices of many insurance products currently heading up (or down), it’s worth understanding exactly where a policyholder’s money goes, once they pay for their retail insurance policy.

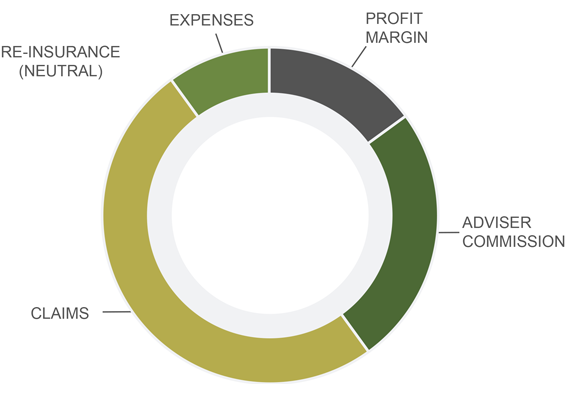

The standard breakdown (broad estimates based on the retail/adviser channel)

Of these, the ‘expenses’ and ‘adviser’s commission’ are relatively fixed, meaning the remaining costs either ends up as variables in profit or claims payouts.

Why claims are rising

Broadly speaking, the economic, social and technological developments of the past 10 to 15 years have contributed to Australians making more expensive claims.

Australians are generally living longer yet are also becoming more overweight (63 per cent of us are now overweight or obese and thus at increased risk of high blood pressure, type 2 diabetes, coronary heart disease, stroke and several cancers).

We also now live in a society where there is much greater awareness of and much less stigma around admitting to mental-health issues. It’s estimated one in five Australians will experience a mental disorder in any one year. While it’s difficult to quantify, it also appears the growth of a more casualised labour market, along with the availability of technology, such as the smartphone, that blurs the boundaries between work time and downtime, has left Australians more prone to both physical and mental health issues.

Finally, it’s also the case that Australians now have higher incomes and, often, larger debts, which leads to higher sums being insured and larger pay outs when a claim is made.

Given these developments, it is perhaps not unexpected that insurance companies would be paying out more on claims. And life companies have indeed been paying out more to customers than forecast, eating into their profitability.

“Rather than, for example, the expected 15 per cent profit margin, it is likely that insurers have had to settle for less, perhaps around 10 per cent, or lower in recent times,” says OnePath head of life insurance Gerard Kerr.

An unsustainable situation

Few people are going to shed any tears over giant life insurers taking a hit to their bottom line. Nonetheless, everyone has an interest in life-insurance companies remaining commercially viable. Profit margins heading towards single figures is a red flag.

“The reason insurance companies aim for a target of approximately 15 per cent is because that is the profit margin that supports the long-term commitments of the products, to allow for fluctuations, and given claims can occur many years into the future,” explains Kerr.

Factors that determine pricing

If insurance companies operating in the Australian market are all confronting the same trends, why do they price their products differently?

Kerr says it comes down to the interplay of segmentation, expenses, shareholder expectations and risk appetite.

“If, for example, Insurance Company A concentrates on providing life-insurance solutions to those in their late twenties, they may be offering cheaper prices, as well as more lenient underwriting, than Insurance Company B, which is focusing on providing policies to those in their mid-forties,” he says.

“Life Company C might target blue-collar workers. That may mean it can offer lower prices while still achieving reasonable profits at the height of a mining boom but must take the risk of its revenue and profit margin taking a hit in a bust. Likewise, Insurance Company D might offer health-and-wellness options, which means it will need to price its product differently to a competitor not offering these options.”

Alternatively, if an insurance company’s shareholders are willing to accept a lower rate of return, it has the flexibility to price its products at a lower rate and possibly gain market share. However, brand positioning means that discounting doesn’t automatically translate into more customers.

“Only an insurer that’s been around for many years and has acquired a reputation for delivering – that is, fulfilling the promise contained in the terms and conditions of its policies – can perhaps charge a premium for this,” says Kerr.

Insurance companies are increasingly utilising big data, such as historical claims information to determine whether policies are performing as forecast. Companies then use this information when devising their pricing structure. For instance, OnePath is broadly raising prices on its OneCare income protection and trauma policies and lowering them on life and total and permanent disability policies for new business. These price adjustments are based on a deep analysis of how different segments of its portfolio have been performing and their evolving risk and claims profile.

Why the industry won’t be Uber-fied

Many industries have been disrupted to date, usually by a new player that automates processes and cuts costs (think Netflix or Uber). Kerr notes that while “insurance companies are embracing automation and analytics and introducing efficiencies at every opportunity, there is always a risk of disruption”.

He believes there are some additional challenges for a new entrant in disrupting the life industry: it’s generally a long-term game – due to the guarantee renewability structure of life policies – therefore if any new entrant wishes to disrupt the sector, then they are going to have to manage their long-term liability too.

This material is intended for the use of financial advisers only and is distributed by OnePath Life Limited (OnePath Life) (ABN 33 009 657 176, AFSL 238341).

The information, opinions and conclusions in articles ("information") are current as at the date articles are written as specified within but are subject to change. The articles are provided and issued by OnePath Life unless another author is specified in the article, in which case it is provided and issued by that author. The views expressed are those of the authors only and do not necessarily reflect the opinions or views of OnePath Life, its employees or directors. Whilst care has been taken in preparing this material, OnePath Life and its related entities do not warrant or represent that the information is accurate or complete. To the extent permitted by law, OnePath Life and its related entities do not accept any responsibility or liability from the use of the information.

The information is of a general nature and has been prepared without taking into account a potential or existing investor’s objectives, financial situation or needs. Investors should consider whether the information is appropriate for them having regard to their objectives, financial situation or needs. For any product referred to above, OnePath Life recommends that investors read any relevant offer document or product disclosure statement and consider if the product is appropriate to them. For products issued by OnePath Life, these documents are available at access.onepathsuperinvest.com.au.

Past performance is not indicative of future performance and any case study shown is for illustrative purposes only. Neither are a prediction of the actual outcomes which will be achieved. Where tax or technical information is included, the information is our interpretation of the law and does not represent tax advice. An investor is advised to obtain professional advice relevant to their individual circumstances.